sales tax oklahoma tulsa ok

While Oklahoma law allows municipalities to collect a local option sales tax of up to 2. The Oklahoma state sales tax rate is.

Oklahoma City Sales Tax Revenue Lags Behind Other Cities In Metro

Web Sales Tax Accountant - Indirect Tax Accountant Tulsa OK This position is responsible primarily for sales and property tax preparation and filings and reports to the Tax Manager.

. Web The latest sales tax rates for cities in Oklahoma OK state. State of Oklahoma 45. Web In the state of Oklahoma sales tax is legally required to be collected from all tangible physical products being sold to a consumer.

The 8517 sales tax rate in Tulsa consists of 45 Oklahoma state sales tax 0367 Tulsa County sales tax and 365. Web The average cumulative sales tax rate in Tulsa County Oklahoma is 88 with a range that spans from 487 to 1063. With over 20 years of accounting and bookkeeping experience AQ Financial handles your books and taxes so you dont have.

Web The Filmed in Oklahoma Act of 2021 increased the cap on the states film rebate program from 8 million to 30 million a year for 10 years and devised a new structure for. Web The Tulsa Oklahoma sales tax is 852 consisting of 450 Oklahoma state sales tax and 402 Tulsa local sales taxesThe local sales tax consists of a 037 county sales. Depending on local municipalities the total.

An example of an item that exempt from. 2020 rates included for use while preparing your income tax deduction. Web Sales tax exemptions apply to Interstate 1-800 WATS and interstate private-line business telecommunication services and to cell phones sold to a vendor who transfers the.

This includes the rates on the state county city and special. This rate includes any state county city and local sales taxes. Web 2483 lower than the maximum sales tax in OK.

The Oklahoma sales tax rate is currently. Web The Tulsa Oklahoma sales tax is 450 the same as the Oklahoma state sales tax. KTUL Oklahoma is one of only 13 states with a grocery tax but that could soon be changing as more and more lawmakers show a willingness to eliminate it.

Web Sales Tax in Tulsa. Rates include state county and city taxes. Inside the City limits of Tulsa the Sales tax and Use tax is 8517 which is allocated between three taxing jurisdictions.

Web What is the retail sales tax in Oklahoma. This is the total of state county and city sales tax rates. 2020 rates included for use while preparing your income tax deduction.

Web 5921 E Admiral Pl. Web The minimum combined 2022 sales tax rate for Tulsa County Oklahoma is 852. This includes the rates on the state county city and.

Web The latest sales tax rate for Tulsa OK. Web The average cumulative sales tax rate in Tulsa Oklahoma is 871 with a range that spans from 852 to 98. It contains 3 bedrooms and 2.

5202 N Tulsa Ave Oklahoma City OK is a single family home that contains 1189 sq ft and was built in 1960. Oklahoma sales tax details The Oklahoma OK state sales tax rate is currently 45. Web The minimum combined 2022 sales tax rate for Tulsa Oklahoma is.

Web Zestimate Home Value. This is the total of state and county sales tax rates.

New Oklahoma Tax Cuts Take Effect Jan 1 Kfor Com Oklahoma City

Best Places To Live In Tulsa Zip 74116 Oklahoma

Sales Tax Relief From Liability In Oklahoma Mcafee Taft

Tulsa County Ok Businesses For Sale Bizbuysell

Moving To Tulsa Here Are 14 Things To Know Extra Space Storage

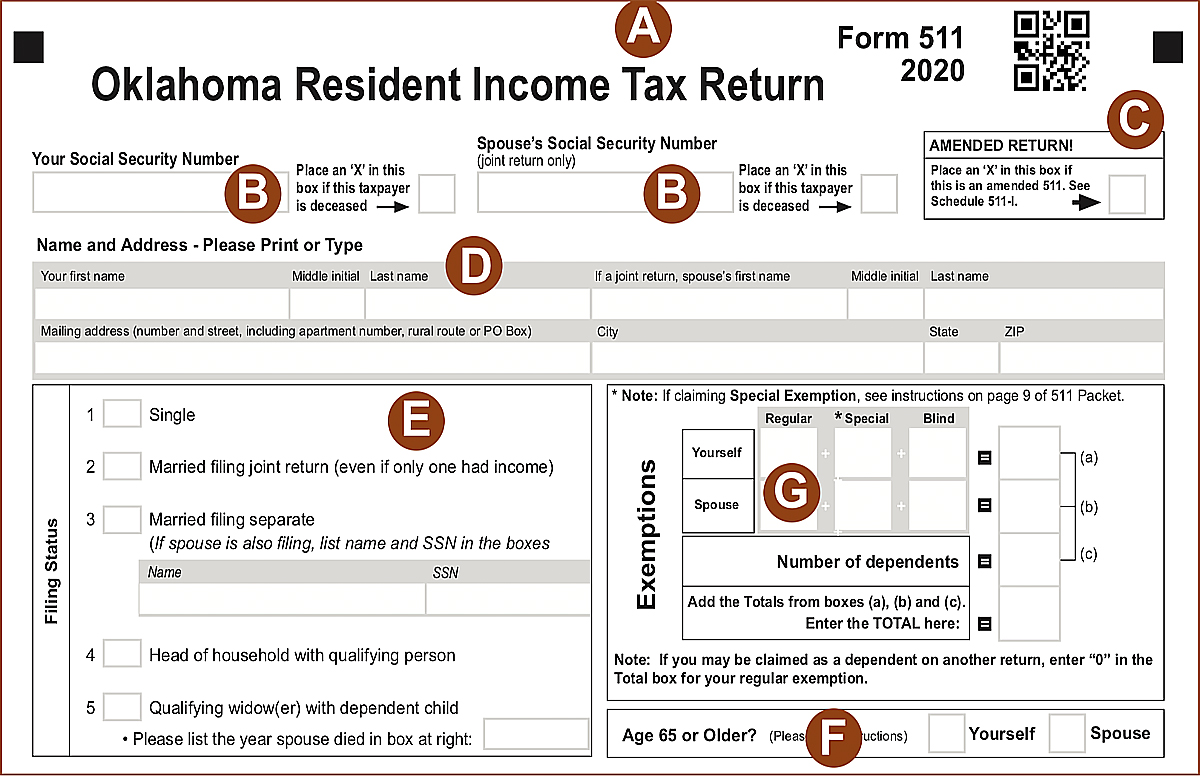

Tax Forms Tax Information Tulsa Library

The Tulsa Real Estate Market Stats And Trends For 2022

Vision2025 Economic Development And Capital Improvement For Tulsa County

Tulsa Oklahoma Ok Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Property Auctions Tulsa County Sheriff S Office

Tulsa Regional Chamber Onevoice State Priorities

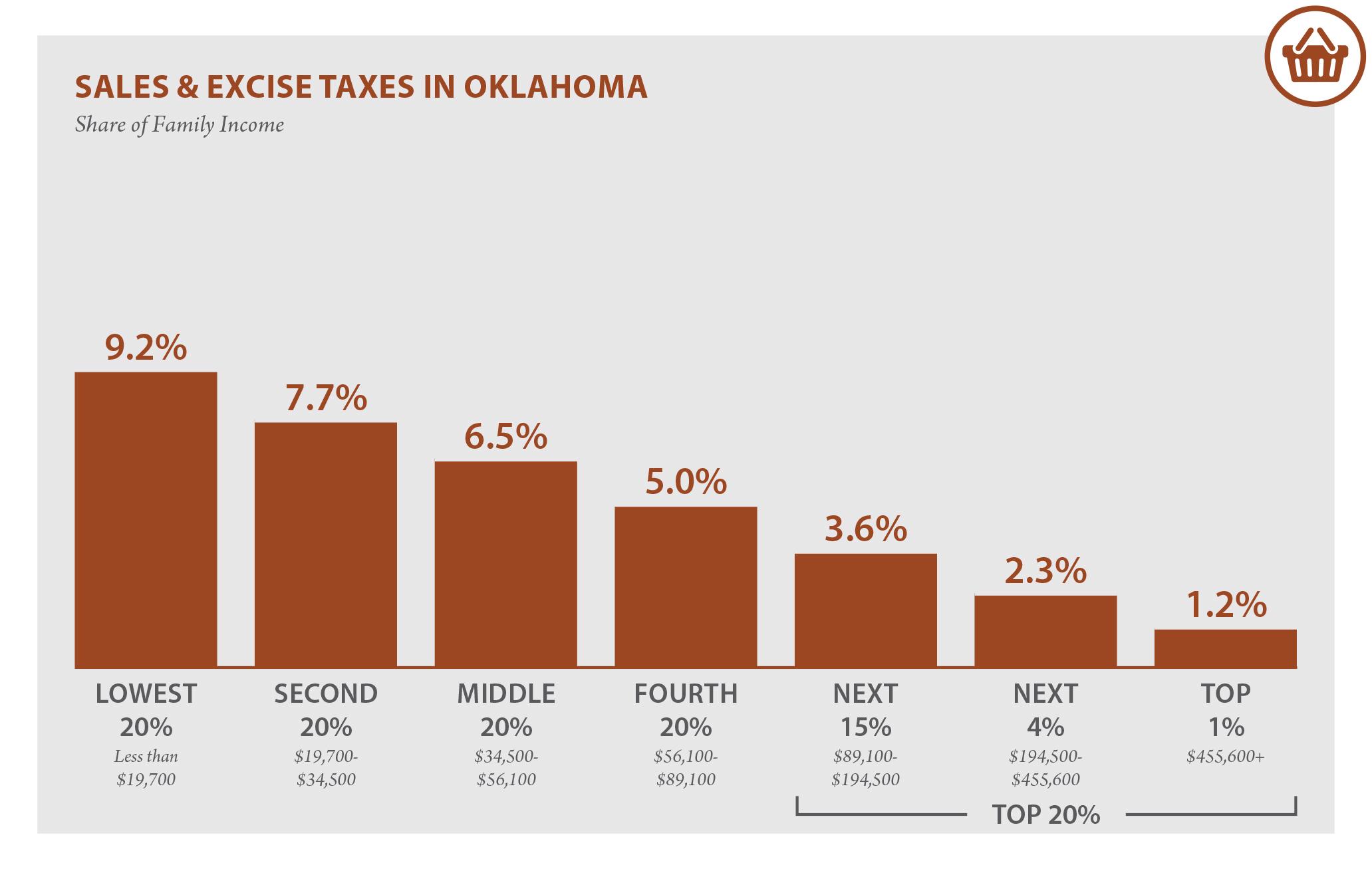

Oklahoma Who Pays 6th Edition Itep

State Says Income Tax Exemption For Tribal Citizens On Reservations Inapplicable Despite Existing Law

Rates And Codes For Sales Use And Lodging Tax Oklahoma Tax

E Commerce And Sales Taxes What You Collect Depends On Where You Ship Oklahoma State University